Tax season will take place.

And this year, Congressional Republicans have turned the tax season into a “selling” season. Republicans and President Donald Trump are pushing for approval of a bill that reapproves the 2017 tax cut package. Otherwise, these taxes will expire later this year.

“We absolutely have to make tax cuts permanent,” says Fox Business' R-Wis. Rep. Tom Tiffany said.

“We need to get the President's tax cuts and employment law updates, which is absolutely essential,” said Senator Minecround of Fox Business.

Fees for almost all American spikes if Congress does not act within the coming months.

Trust in the Democrats is much lower in new polls

R-La. House Speaker Mike Johnson will speak with the media after the House passed its budget resolution on Thursday, April 10, 2025. (Tom Williams/CQ-Roll Call, Inc, Getty Images)

“We are trying to avoid tax increases for our country's most vulnerable groups,” said Rep. Beth Van Duyne, R-Texas, who is a member of the House Ways and the instrumental committee, which determines tax policy. “I'm trying to avoid a recession.”

If Congress meets by chance, the Nonpartisan Tax Foundation estimates that a couple with two children (which earns $165,000 a year) are slapped for an additional $2,400 tax. Single parents without children who earn $75,000 a year could see an upcharge of $1,700 on the tax bill. Single parents of two children who bring $52,000 a year home will be slapped for $1,400 a year in taxes.

“It's pretty important. It's an additional mortgage payment or an additional rent payment,” said Daniel Vann of the Nonpartisan Tax Foundation. “People are getting used to living with policies that are currently in law for nearly eight years now, and the shift to policies that were pre-tax cuts in 2017 will be a dramatic tax cut for many.”

But technically, Republicans aren't cutting taxes.

“I'm as simple as I can make this bill, and it's about keeping the tax rates the same,” said Sen. James Lankford, R-Oklahoma of Fox.

Congress had to write the 2017 tax reduction bill in one way so that the cuts expire this year. That was for accounting purposes. As long as it expired within a multi-year window, Congress did not have to count tax cuts on deficits, thanks to several tricky numerical mechanisms. But the result could have increased taxes if lawmakers were unable to update the old cuts.

“It's sunset so we'll just automatically return to tax levels before 2017,” said Sen. Chuck Grassley, R-Iowa.

A recent Fox News poll shows that 45% of those surveyed and 44% of independents believe that the rich don't pay enough taxes.

Democrats hope to change their anger over perceptions of tax disparities against Trump.

“He hopes to get even bigger tax cuts on his fellow billionaires. Is that dishonorable?” asked Senate minority leader Chuck Schumer, DN.Y. at a rally in New York.

“Strange!” cried out someone in the crowd.

“Strange! Strange!” Follow-up Schumer.

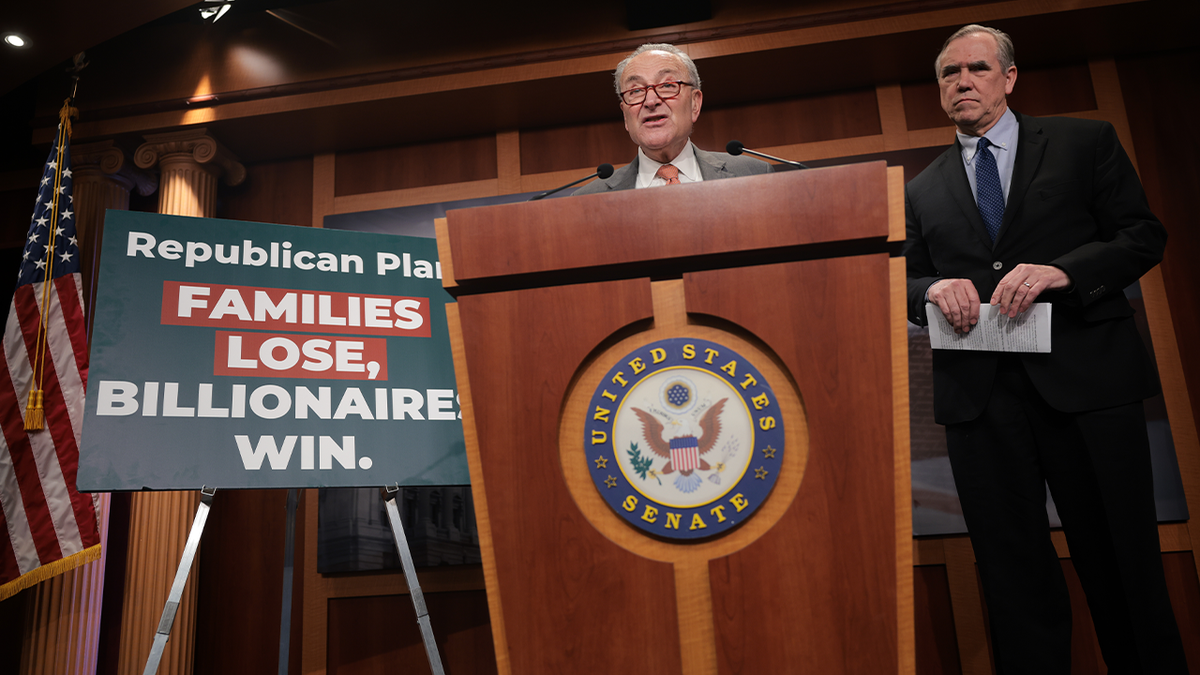

Chuck Schumer, DN.Y, a minority leader in the US Senate. (R) will speak to reporters along with Senator Jeff Markley during a press conference on the impact of the Republican budget proposals in U.S. Congressional lawmakers held in DC on April 10, 2025. (Kayla Bartkowski/Getty Images)

Some Republicans are now exploring increased fees for wealthy or businesses. Capitol Hill and the administration had chatter about exploring an additional set of tax frames.

“I don't think the president has decided whether he supports it or not,” said White House spokeswoman Karoline Leavitt.

“We're going to see where the president is,” said Scott Bescent, a Treasury Department, while traveling to Argentina. “It's all on the table.”

A spokesman for the Treasury later revealed Bescent's remarks.

“What's off the table is a $4.4 trillion tax increase on Americans,” the spokesman said. “And also, corporate tax cuts will create a manufacturing boom and once again will rapidly grow the US economy.”

The top GOP leader in Congress has rejected the idea.

“I'm not a huge fan of doing that,” House Speaker Fox said. “We are Republicans and we are for tax cuts for everyone.”

Federal judges temporarily restrict Doge access to personalized social security data

“I don't support that initiative,” and before adding “It's all on the table,” R-LA in Fox Business.

But if you're President Donald Trump and President GOP, consider the politics of creating new corporate tax rates or hiking wealthy.

Sunrise Light will hit the dome of the U.S. Capitol on Thursday, January 2, 2025 as the 119th Congress is scheduled to begin on Friday. (Bill Clark/CQ-Roll Call, Inc, Getty Images)

The President has expanded the GOP base. Republicans are no longer “wealthy” parties. Manual workers, shopkeepers, shopkeepers and small business people now make up Trump's GOP. Therefore, maintaining these tax cuts will help that working class core. Tax increases for the wealthy will help Republicans pay tax cuts and reduce the blow to the deficit. And it would protect Republicans from Democrats' claim that tax cuts are for the rich.

The council is currently in the middle of a two-week break for Passover and Easter. GOP lawmakers and staff work behind the scenes to actually write bills. No one knows exactly what the bill has. Trump has not promised taxes on tips for foodservice workers. There is also talk that overtime does not have taxes.

White House photos show how political parties stand in immigrants amid Abrego Garcia's deportation

Republicans in high-tax states like New York and Pennsylvania want to see a decline in “salt.” It is where taxpayers can amortize “state and local taxes.” This provision is important to ensure the support of Republicans like lawmakers. Nicole Mariotakis, RN.Y. , Mike Roller, RN.Y. However, including a decrease in salt, the deficit also increases.

So, what does the bill look like?

“The minor adjustments in it are naturally on the table,” Round said. “But the keys are 218 in the house and 51 in the Senate.”

In other words, it's about mathematics. Republicans need to develop the right legislative brewing that will pass the right amount of votes in both chambers. That could mean the inclusion of certain clauses. It's challenging. Especially in the majority of slim homes.

On April 10, 2025, people will attend press conferences and meetings to support fair taxation near the US Capitol in Washington, D.C. (Bryan Dozier/Middle East Images/Middle East Images via AFP)

“The bill had a trade-off and offset that many people were unhappy,” said the 2017 bill's van. “And it's not clear how the package will come together with these various trade-offs.”

Johnson hopes the bill will be completed by anniversary. Republicans know that the company can't be too late this year. Taxpayers will see tax increases, whether temporary, if they resolve the bill when the IRS begins preparing for the next tax season.

It is also believed that completing this earlier than later will provide some degree of stability in the volatile stock market. Establishing tax policies for next year will alleviate uncertainty about the country's economic outlook.

“Big and beautiful bill,” Trump called it, adding that he wanted to “quickly” the law.

Click here to get the Fox News app

And that's why tax season is now on sale. Both are lawmakers. And in general.