On Saturday, the White House released a survey estimated that between 82 and 9.2 million Americans could be health insurance if the “big, beautiful bill” on President Donald Trump's budget is not passed, as a result of the subsequent recession.

The findings come from a White House economic advisor's memo entitled “Opportunity costs for health insurance if the 2025 budget adjustment bill is not passed.”

The survey assumes that there were around 27 million uninsured people in the United States in 2025. If the budget bill is not passed, it could increase in 2010 to around 50 million uninsured people who were uninsured prior to the implementation of the Affordable Care Act (ACA), also known as Obamacare.

“Failure is not an option”: Trump's budget bill will be “great” support for seniors, says a top house tax author, says Trump's budget author

President Donald Trump was sworn at the special envoy at the oval office in the White House in Washington, DC, President Steve Witkoff's oathing ceremony. (Reuters/Kent Nishimura/File Photo)

The memo says the estimate is “based on the assumption that states that expanded Medicaid with relatively generous eligibility will meet balanced budget requirements and seek to provide more unemployment assistance in severe recessions.” We also revise the conclusion by stating that the analysis assumes “there is no policy measures.” The White House describes it as a “very impossible, but plausible, bad case” scenario.

The White House predicts that Trump's tax cuts in 2026 and other shocks will cause a “medium to severe recession.” Economic advisors report a “major recession” will result in a decline in consumer spending as a result of an increase in personal taxes, reduced SMEs and consequently higher pass-through individual taxes, global trust shocks including concerns about US competitiveness, and increased credit tightening and real interest rate pushes.

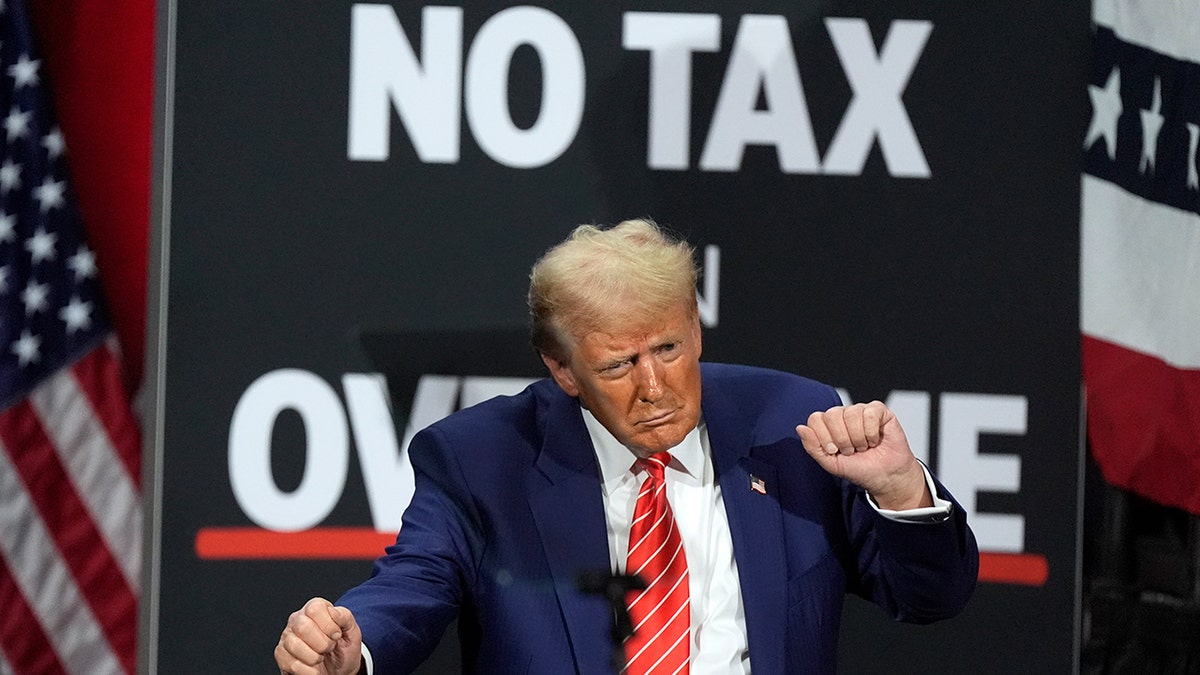

Republican presidential candidate Donald Trump will dance at a campaign event at the Cobb Energy Performing Arts Center in Atlanta on October 15, 2024. (AP Photo/John Bazemore, file)

GOP Rebel Mutiny threatens to derail Trump's “big and beautiful bill” before the main committee hurdle

According to the advisor's “cap,” estimates of the impact of not extending Trump's tax cuts show that US GDP can sign approximately 4% over two years, similar to the 2008 recession. The unemployment rate could increase by 4 percentage points, resulting in around 6.5 million unemployment. Of these 6.5 million job losses, 60% were in employer-sponsored insurance, so the White House predicts that around 3.9 million people have lost coverage and as a result they are not insured.

The memo also anticipates losses in personal and market coverage as employer-sponsored uninsured people can no longer afford to buy themselves. The White House expects a 15% reduction to coverage losses of around 3.3 million people from around 22 million in 2026.

House speaker Mike Johnson, R-LA. will speak at a press conference at the Capitol Building in Washington on May 6, 2025. (AP Photo/Rod Lamkey, Jr., File)

Without the passage of the “big and beautiful bill,” registrations for Medicaid and ACA subsidized plans could experience 10% registration friction, with about 500,000 to 1 million people losing or not getting compensation, the memo said. According to the White House, the expiration of Trump's tax cuts in 2017 will disproportionately affect non-citizens, gig workers and early retirements. Advisors rated these employer-sponsored working-class individuals as unable to pay coverage as a result of the recession, leading to 500,000 to 1 million insurance losses among the “fragile segments.”

House speaker Mike Johnson, R-La. is striving to get “one big beautiful act” through the home, despite being split among Republicans.

The 1,116-page invoice includes tax cuts of more than $5 trillion, costs partially offset by spending cuts elsewhere, and other changes to the tax law, which will result in permanent tax cuts from Trump's first term.

Click here to get the Fox News app

It also delivers many of the promises of Trump's campaign. This involves creating a new tax-free “MAGA account” that will end temporary taxes on overtime for many workers, as well as a new $10,000 tax cut on interest on car loans on American-made cars, and donate $1,000 to children born in the second term.

The Associated Press contributed to this report.